Three Black Crows Candlestick Pattern – Formation, Trading, Limitations & Use

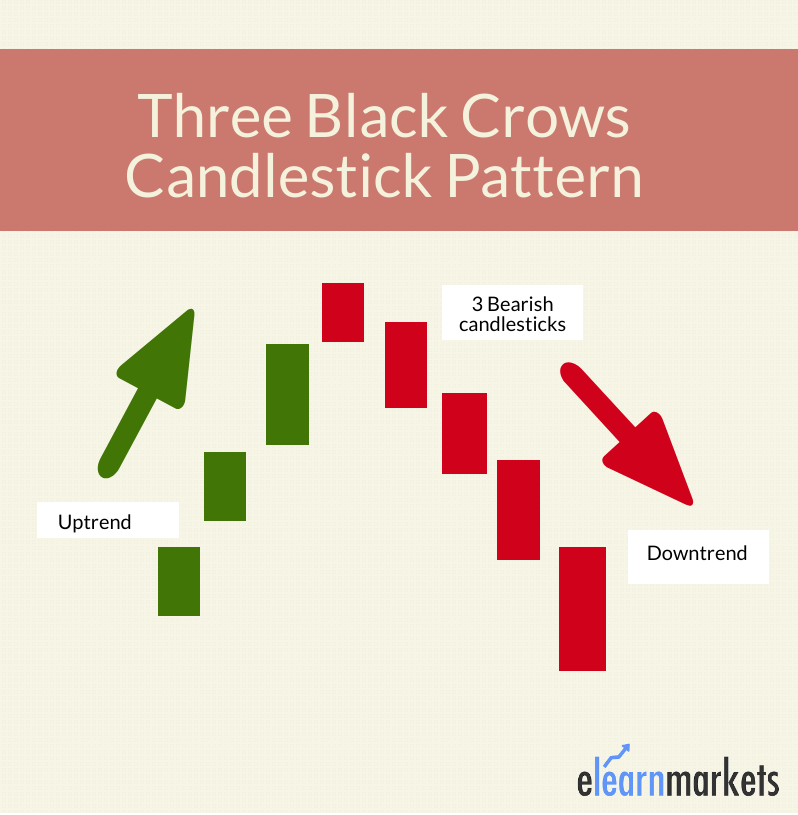

The Three Crows pattern is a bearish reversal pattern that consists of three bearish long-bodied candlesticks.

Each of the three candlesticks should be long bodied bearish candlesticks, each candlestick opening price should be lower than the previous candlestick’s opening price.

It is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend.

The Three crows pattern signal weakness in an ongoing uptrend and the potential reversal to the downtrend.

Let us discuss in details how we can trade with this bearish reversal candlestick pattern:

What is the Three Black Crows Candlestick Pattern?

Three Crows pattern is a multiple candlestick chart pattern that is used to predict reversal to the downtrend.

This candlestick pattern is formed when the bearish forces come into the action and make the prices fall for three consecutive days.

Traders should take a short position after this bearish candlestick pattern is formed.

Traders can also take the help of volume and technical indicators to confirm the formation of this candlestick pattern.

Formation of Three Black Crows:

Here is the Formation of Three Crows pattern:

How to trade with this Three Black Crows Pattern ?

Let us discuss how to trade with this candlestick pattern step by step:

1st Candle:

The first candlestick of this pattern should be long bodied bearish candlestick and must be formed as the continuation of the ongoing uptrend.

A bearish candle means that the closing price should be lower than the opening price as the bears are trying to make the prices fall.

2nd Candle:

The second candlestick should also be a bearish candle. It can be long or short bodied.

The opening price of this candlestick should lie within the real body of the first candlestick i.e should be in between the midpoint or the closing of the first candle.

Learn to Identify Trend Reversals with Candlesticks in just 2 hours by Market Experts

The second candle should not break the high of the first candlestick.

3rd Candle:

The third candlestick should also be a bearish candle. It can either be a long or short-bodied candle.

The opening price of this candlestick should lie within the real body of the second candlestick i.e should be the midpoint or the closing of the second candle.

The third candle should not break the high of the second candlestick.

One should note that these three candlesticks can be Bearish Marubozu.

A Bearish Marubozu candlestick pattern is a long-bodied bearish candlestick in which the closing price is the low price and the opening price is the high price for that day.

There are no shadows in the Bearish Marubozu.

Example:

Below is an example of daily chart of Phillips Carbon Black Ltd. that shows us how Three Black Crows Candlestick pattern is formed after an uptrend and the trend got reversed to downtrend after the formation of candlestick pattern.

To know about other candlesticks, read our blog on All 35 Candlestick Chart Patterns in the Stock Market-Explained

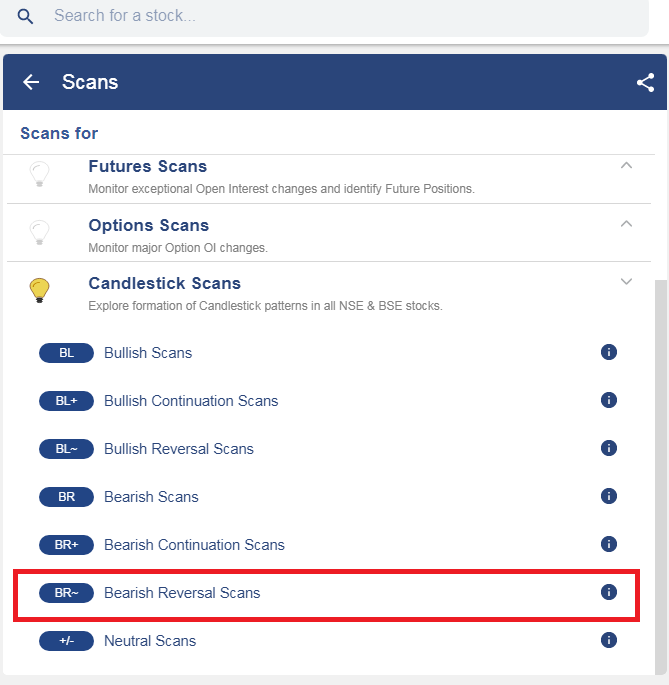

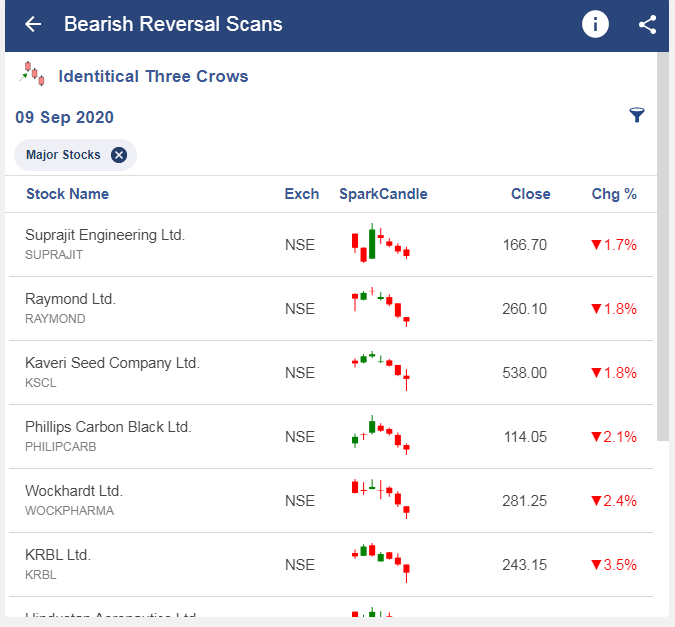

How to use the Three Black Crows pattern in StockEdge ?

You can also use the Three Black Crows Candlestick scans in StockEdge web version:

Steps to use Three Crows pattern scans in StockEdge:

Under the “Candlestick Scans” we can see Bearish Reversal scans as shown below:

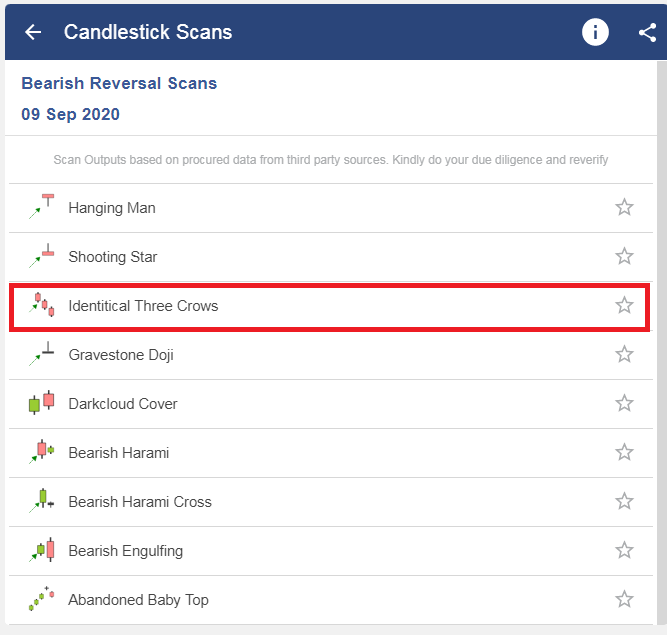

When we click on the “Bearish Reversal scans” we can see “Three Crows Pattern” scan, click on that:

After selecting on it, you will get a list of stocks in which the “Three Black Crows” pattern is formed.

Limitations:

As the three crows pattern makes the prices to fall, traders should be cautioned of the oversold conditions that may lead to consolidation before a further move down of the prices.

Traders should also look at other chart patterns or technical indicators for confirming the reversal than just using the three black crows pattern exclusively.

Key Takeaways:

- The Three Crows pattern is a bearish reversal pattern that consists of three bearish long-bodied candlesticks.

- The Three Black Crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend.

- One should note that these three candlesticks can be Bearish Marubozu

- Traders can also take the help of volume and technical indicators to confirm the formation of this candlestick pattern.

Happy Learning!