How to Trade with Inverted Hammer: Candlestick Pattern

Inverted Hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure for pushing the price of the stocks upwards.

This is a reversal candlestick pattern that appears at the bottom of a downtrend and signals a potential bullish reversal.

This candlestick pattern gets its name from an inverted hammer in real life.

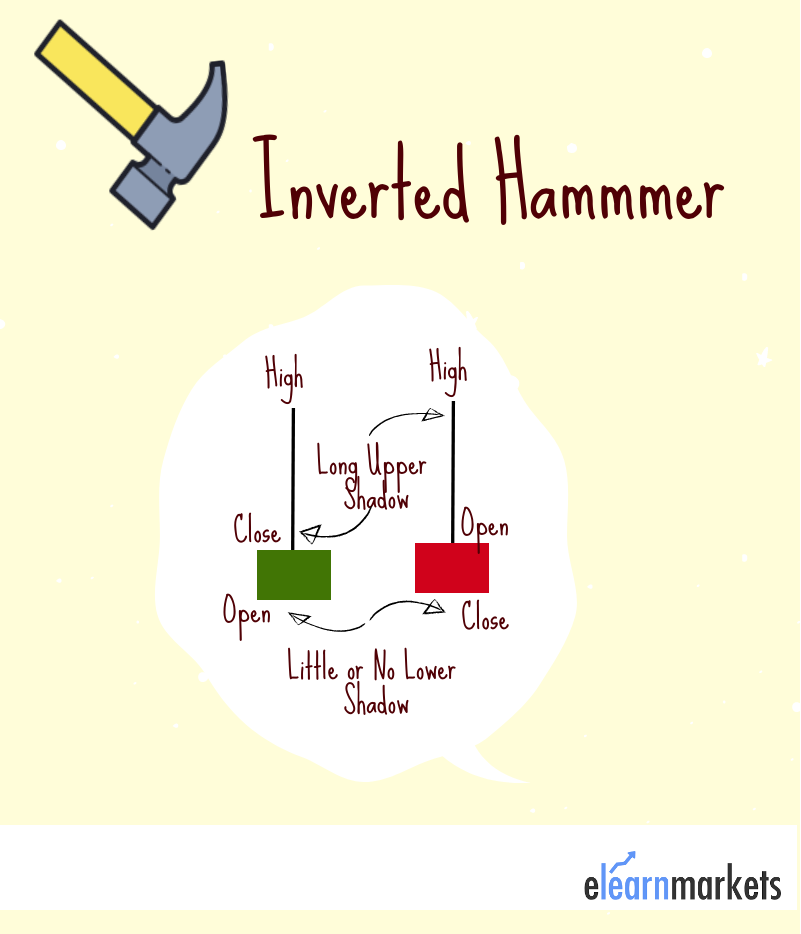

Formation of Inverted Hammer:

This candlestick pattern has a long shadow at the top and there is no shadow at the bottom.

The length of the long shadow is usually the twice of the height of the real body of the candlestick as shown below:

This candlestick is formed when bullish traders start again to gain confidence after sellers have pushed the prices downwards.

The upper shadow is formed when the bulls try to push the price up whereas the lower part of the shadow is formed by the bears, who try to resist the higher price.

However, the pressure by the bulls is strong enough to close at a higher price.

What does Inverted Hammer tell you?

The Inverted Hammer is a signal of bullish reversal after a downtrend.

It tells the traders that the bulls are now willing to buy the stock at the fallen prices. After the downtrend, there is pressure from the buyers in the market to raise the stock prices.

It tells the sellers in the market to exit as they may be a bullish reversal and tells the buyers to enter their buying position as the bullish trend is about to start.

But remember to confirm this signal with other technical indicators as it may sometimes fall signals.

You can also wait for the next trading day to confirm the beginning of the bullish trend.

If in the next trading session the opening price is more than the closing price of the inverted hammer candlestick then you can enter the buy position.

To know about other candlesticks, read our blog on All 35 Candlestick Chart Patterns in the Stock Market-Explained

Few Aspects to look for when trading with Inverted Hammer:

When we start analyzing the stocks using this inverted hammer candlestick pattern, there are certain aspects that we should look for.

Below are a few aspects which will help you in trading with an inverted hammer candlestick pattern:

1. Confirm the pattern:

There are certain confirmation criteria that traders should consider when taking the trade using an Inverted Hammer candlestick.

- The trader should first verify that the length of the upper shadow is more than twice of the real body.

- If the formation Inverted Hammers occurs with a gap down from the previous day candlestick, then the chances of reversal are stronger.

- The volume in trading should be high on the day of the formation of the Inverted Hammer candlestick pattern. High volume signifies that buyers have entered the market and exerting pressure the increase the price of the stock.

- It is better to enter the buying position the next day if the price opens higher.

- Before entering into the trade, the trader must consider the above criteria to confirm the bullish reversal signal given by the Inverted Hammer.

2. The psychology behind the pattern:

The prior trend should be a downtrend which means that the prices should be making lower lows and there should be selling pressure exerted by the sellers to make the price fall.

When this candlestick forms, it shows that the bulls are back into the market and have started putting buying pressure to make the prices rise high and bears are unable to bring the price down.

If the price maintains its strength even in the next trading session, one can enter the buy position.

3. Don’t get confused with other candlestick patterns:

Traders often get confused between the inverted hammer and shooting star candlestick pattern. But one should note that the inverted hammer occurs after the downtrend whereas shooting start happens after an uptrend.

You can also use technical scans to filter out stocks for trading the next day by using StockEdge App, now also available in the web version.

Key Takeaways:

- Inverted Hammer reversal candlestick pattern which appears at the bottom of a downtrend and signals a potential bullish reversal.

- This candlestick pattern has a long shadow at the top and there is no shadow at the bottom.

- An inverted hammer candlestick pattern is formed when bullish traders start again to gain confidence after sellers have pushed the prices downwards.

- The volume should be high on the day of the formation of the Inverted Hammer candlestick pattern

- Confirm this signal with other technical indicators as it may sometimes fall signals.

Did you find the Inverted Hammer candlestick pattern useful? Tell us by commenting below.

Happy Learning !