Doji Candlestick Pattern – Formation, Types & Example-ok

A Doji is a candlestick pattern that looks like a cross as the opening and closing prices are equal or almost the same.

The word Doji is of Japanese origin which means blunder or mistake that refers to the rarity of having the open and close price be exactly the same.

Let us drive into the details of this candlestick pattern:

What is Doji candlestick pattern?

The Doji candlestick pattern can lead to high profits in trading.

The versatility of this candlestick pattern is appreciated by all types of traders for different time frames.

The Doji candlestick pattern is a formation that occurs when a market’s open price and close price are almost exactly the same.

How is a Doji candlestick Pattern formed?

This candlestick is formed when the market opens and bullish traders push prices up whereas the bearish traders reject the higher price and push it back down.

It could also be that bearish traders try to push prices as low as possible, and the bulls fight back and push the price up.

The upward and downward movements that happen between open and close form the wick.

The body is formed when the price closes at or almost the same level as it opened.

What does a Doji tell traders?

When looked at in isolation, a Doji indicates that neither the buyers nor sellers are gaining – it’s a sign of indecision.

Whereas some traders believe that the Doji indicates an upcoming price reversal when viewed alongside other candlestick patterns, but this may not always be the case.

It could indicate that buyers or sellers are gaining momentum for the continuation of the ongoing trend.

It’s important to remember that the Doji candlestick does not provide as much information as one would need to make a decision.

Before acting on any signals, including the Doji candlestick chart pattern, one should always consider other patterns and indicators.

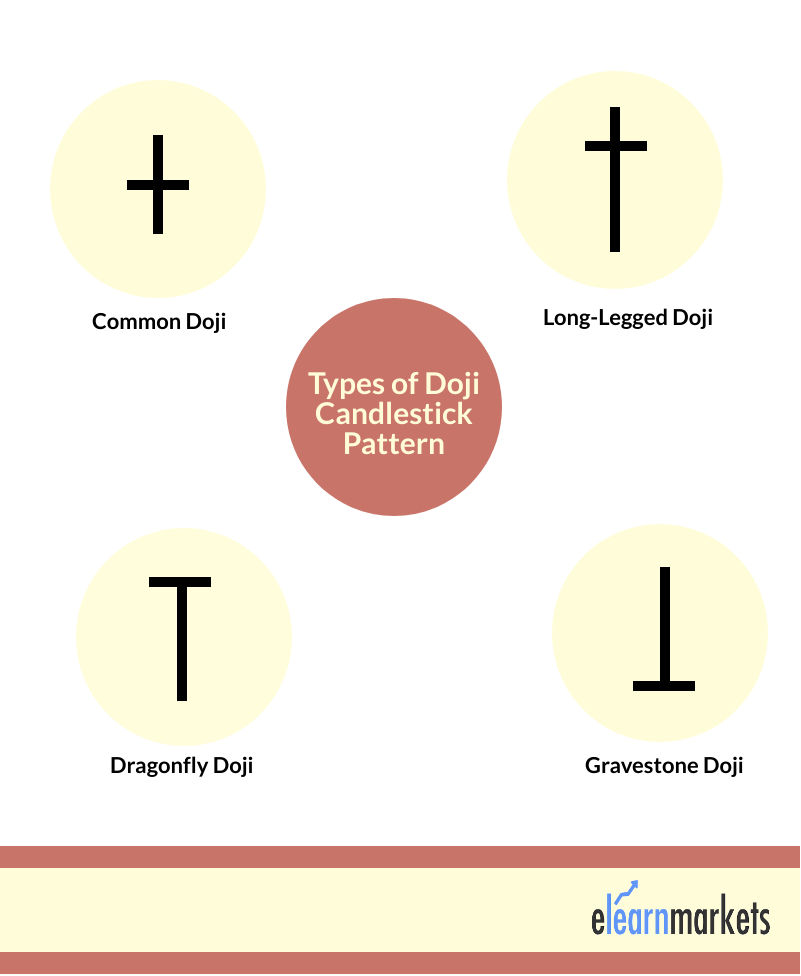

Types of Doji Candlestick Pattern:

There are different types of Doji patterns, namely the Common Doji, Gravestone Doji, Dragonfly Doji and Long-Legged Doji.

Let us discuss about them:

1. Neutral Doji

This is the most common type of Doji candlestick pattern.

When buying and selling are almost the same, this pattern occurs.

The future direction of the trend is uncertain as indicated by this Doji pattern.

2. Long-Legged Doji

As the name suggests this is a long-legged candlestick pattern.

When the supply and demand factors are at equilibrium, then this pattern occurs. The trend’s future direction is regulated by the prior trend and Doji pattern.

3. Gravestone Doji

This pattern is found at the end of the uptrend when supply and demand factors are equal.

At the day’s low, the candlestick opens and closes. The prior trend and Doji pattern regulate the future direction of the trend.

4. Dragonfly Doji

This pattern appears at the end of the downtrend when the supply and demand factors are at equilibrium.

To know about other candlesticks, read our blog on All 35 Candlestick Chart Patterns in the Stock Market-Explained

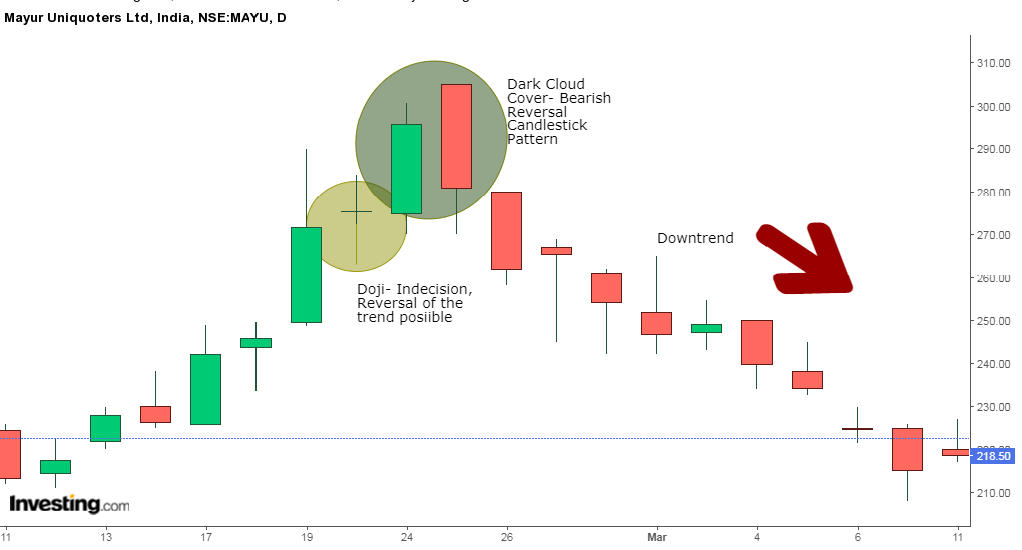

Doji Example:

In the below chart of Mayur Uniquoters Ltd, we can see that at the end of the uptrend, a Doji is formed, indicating that the ongoing trend has become certain.

The Doji is then followed by the Dark Cloud Cover candlestick pattern that confirms that the reversal is going to take place, as shown below:

What is the Difference between a Doji and a Spinning Top?

The spinning top is quite similar to doji, but its body is larger when compared to Doji.

A candle’s real body generally represent up to 5% of the size of the entire candle’s range to be a Doji candlestick pattern.

Any more than that, it becomes a spinning top. A spinning top candlestick also signals weakness in the current trend.

Suggested Read – How to trade with Spinning Top ?

If either a Doji or spinning top is spotted, then traders should look to other indicators, such as Bollinger Bands, for determining the context to decide if they indicate trend continuation or reversal.