How is US Inflation affecting the Indian Stock Market?

Rise in Inflation in the US? But why it is affecting the Indian Stock Market?

Yes, India Stock markets were under heavy selling pressure as there was a spike in US inflation and the expectations that the US Federal Reserve would hike the rate for controlling the money supply in the economy and bringing down Inflation.

Also, another reason for the selling off in the stock markets is due to conflict between Russia and Ukraine. The US on Monday warned that Russia could invade Ukraine at any time, which pushed oil prices to seven-year highs and sent investors scurrying to buy safe-haven government bonds.

So, in today’s blog, we will discuss how Indian Stock Markets are getting affected by the rise in the US Inflation rate:

What is Inflation?

In simple terms, Inflation refers to a gradual increase in the prices of goods and services. So when Inflation rises, the cost of living increases, leading to a lower purchasing price.

When the average income of people rises, more products and services are bought. Due to this, demand increases more than the supply of goods and services.

Thus, goods and services are scarce, which makes the buyers pay more, leading to increases in prices that cause a rise in inflation in the economy.

Inflation and Stock Markets

When this rate rises, the Fed raises the loans and deposits rates to reduce the money supply in the economy. The main goal is to encourage people to save money and reduce liquidity by bringing the rates down.

As the rates get costlier, the capital cost for companies increases and the projected cash flows are valued lower.

Now let us discuss how it impacts the stocks:

As these rates rise, the speculation about the products and services also rises, which leads to a volatile market. The change in the inflation rates largely impacts value stocks as their stock prices are directly linked to this rate.

Thus, when this rate rises, the prices of the value stocks also increase and perform better. Whereas growth stocks have a negative relationship with this rate. The prices of the growth stocks drop when this rate decreases.

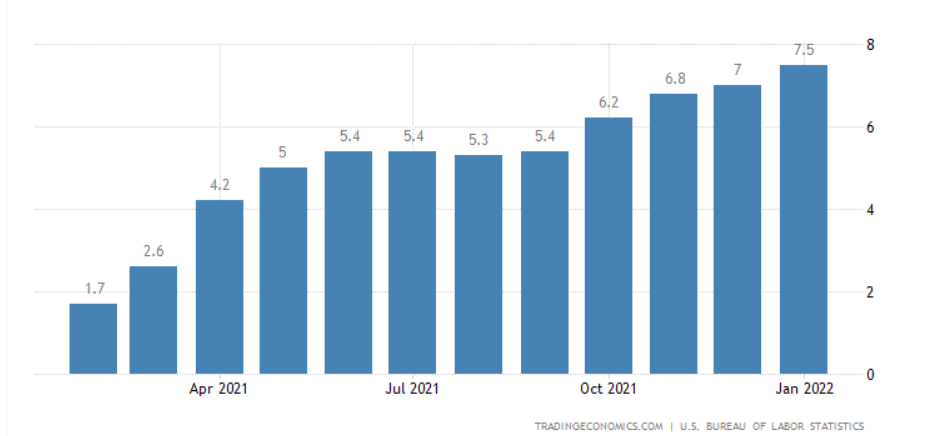

US Inflation

US inflation rose to a new 40-year high of 7.5 percent in January, with the annual core rate excluding food and energy running at 6 percent, the fastest since 1982.

Because of this reason, it was speculated that the Fed could raise the rates and halt its bond-buying programme which markets are accustomed to.

So, a rise in the US interest rates and a cut down of bond-buying by the Fed will reduce the dollar supply, leading to redemption in global funds.

This would also force funds to sell equities aggressively to readjust to the new liquidity scenario.

You can also join our course on CERTIFICATION IN ONLINE FIXED INCOME AND INTEREST RATE FUTURES

How it Affected the Global Markets?

Due to the rise in Inflation, the Dow Jones Industrial Average fell 1.47%, and the S&P 500 lost 1.8% to 4504.06. The NASDAQ also dropped to 2.1%, which was the seventh time in 2022 that NASDAQ lost more than 2% in a day.

Due to this, the Indian stock market also became volatile- BSE Sensex fell 773 points or 1.3 per cent to 58,153, while Nifty finished at 17374, down 231 points or 1.3 per cent.

Bottomline

This is how the rises in inflation rates in the US affected the global markets, as discussed above. Therefore, investors and traders should avoid panic and emotional-based decisions during rising inflation times and invest in strong fundamental stocks.

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy!

Happy Investing!

You can also visit web.stockedge.com is a unique platform, which is 100% focused on research and analytics.